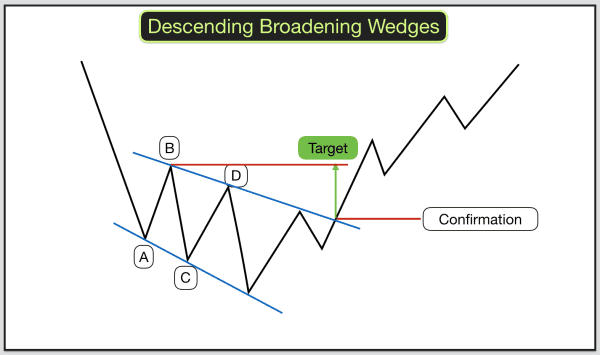

Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. The price action is moving up within the wedge, but the price waves are getting smaller. The Cyber Security share basket, which is also available to trade on our platform, provides an example of an ascending wedge. If the price breaks higher out of the pattern, the uptrend may be continuing. When a falling wedge occurs in an overall uptrend, it shows that the price is lowering, and price movements are getting smaller. The rally begins to lose momentum, and divergence with the RSI indicator appears, symptomatic of rising wedge patterns. Notice how price action is forming new highs, but at a much slower pace than when price makes higher lows. In this first example, a rising wedge formed at the end of an uptrend. If the market breaks the support trend line and rallies up to new highs, then some other pattern is playing out and the rising wedge has failed. Thestop lossfor a short trade will be placed just above the recent swing high. A third wave forms afterwards but the sellers lose control again after the formation of new lowest points. A second wave of decline then occurs of more magnitude, signalling the sellers’ loss of control after a new lowest point. The highest point reached during the first correction on the descending broadening wedge’s resistance line forms the resistance.

These choppy waves make upward progress, but it’s slow and overlapping. Beginning Jan 31, ETH price begins to rally in choppy waves - i.e., when new highs are formed, then immediately met with a corrective trend. If you wait for the candle to close, you could be missing out on a better entry point.

#Descending wedge flag how to

The Basics of Reading Charts Covered If you are new to crypto trading and learning how to read crypto charts, this is the right place. are expected to exhibit mean reversion properties. The components of a stock such as prices, volatility, etc. Mean reverting strategies are designed under the assumption that over time, the prices and the economic indicators move back to their mean. Hypothetical performance results have many inherent limitations, some of which are described below. When the stock is trending up, the moving averages of the price angle up and trends higher along with the price.ĭeepen your knowledge of technical analysis indicators and hone your skills as a trader. Falling Wedge Pattern For long-term trading, 50-day moving average, 200-day moving average are considered as shorter and longer period moving averages. The sell signal was generated on 20th December 2018 when the 50-day moving average crossed below the 200-day moving average. On 2nd September 2016, a buy signal was generated when the 50-day moving average crossed above the 200-day moving average. The upside breakout in price from the wedge, accompanied by the divergence on the stochastic, helped anticipate the rise in price that followed. A minimum of two higher highs is needed for the resistance line. The resistance trend line needs to cover the extreme high points of the pattern. Once this strong trend has developed, and large crypto whales are no longer interested in buying, the price will begin to correct, drawing in the FOMO buyers. #4 Triple & Double Top & Bottom Cryptocurrency Chart Patterns At this point, the rising wedge pattern has formed and the market is ripe for a large correction. Reversal patterns, however, form at the end of trends, after which the market changes direction. Continuation patterns manifest as an interruption of the larger trend. In circumstances like this, the market is mature for a reversal. If the volume is falling as the wedge pattern advances, then this indicates bullish whales are no longer supporting the price. Other traders sell short once the price has breached the trend line by a specified amount, like 50 or 100 points. Broadening Formation Definition – Technical Analysis – Investopediaīroadening Formation Definition – Technical Analysis.

0 kommentar(er)

0 kommentar(er)